SME FINANCE SUMMIT

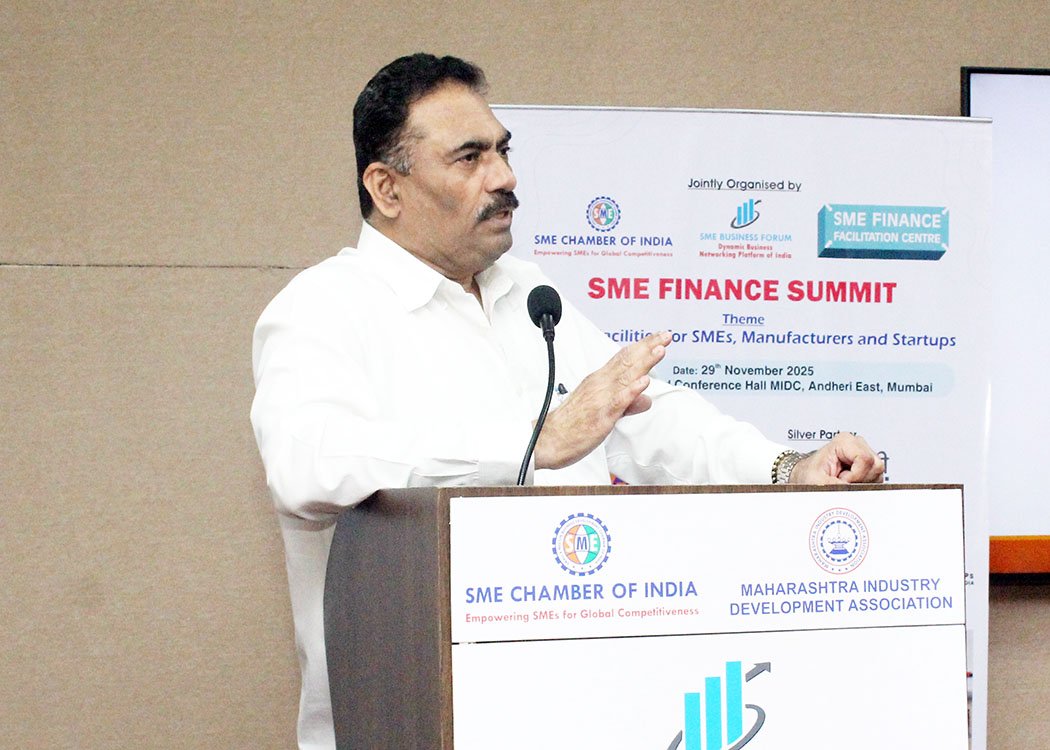

Mr. Chandrakant Salunkhe – Founder & President, SME Chamber of India addressing the delegates Mr. Divik Sahni – Assistant General Manager, SIDBI addressing the delegates on Equipment Financing schemes for MSMEs Mr. Prem Singh Rajvi – National Business Manager – Business Banking, AU Small Finance Bank Ltd. addressing the delegates on Working Capital and other […]

Continue Reading